For the taxable years beginning in 2022, the dollar limitation for employee salary reductions for contributions to health flexible spending arrangements increases to $2,850.For tax year 2022, the monthly limitation for the qualified transportation fringe benefit and the monthly limitation for qualified parking increases to $280.The revenue procedure contains a table providing maximum EITC amount for other categories, income thresholds and phase-outs. The tax year 2022 maximum Earned Income Tax Credit amount is $6,935 for qualifying taxpayers who have three or more qualifying children, up from $6,728 for tax year 2021.The 2021 exemption amount was $73,600 and began to phase out at $523,600 ($114,600 for married couples filing jointly for whom the exemption began to phase out at $1,047,200). The Alternative Minimum Tax exemption amount for tax year 2022 is $75,900 and begins to phase out at $539,900 ($118,100 for married couples filing jointly for whom the exemption begins to phase out at $1,079,800).

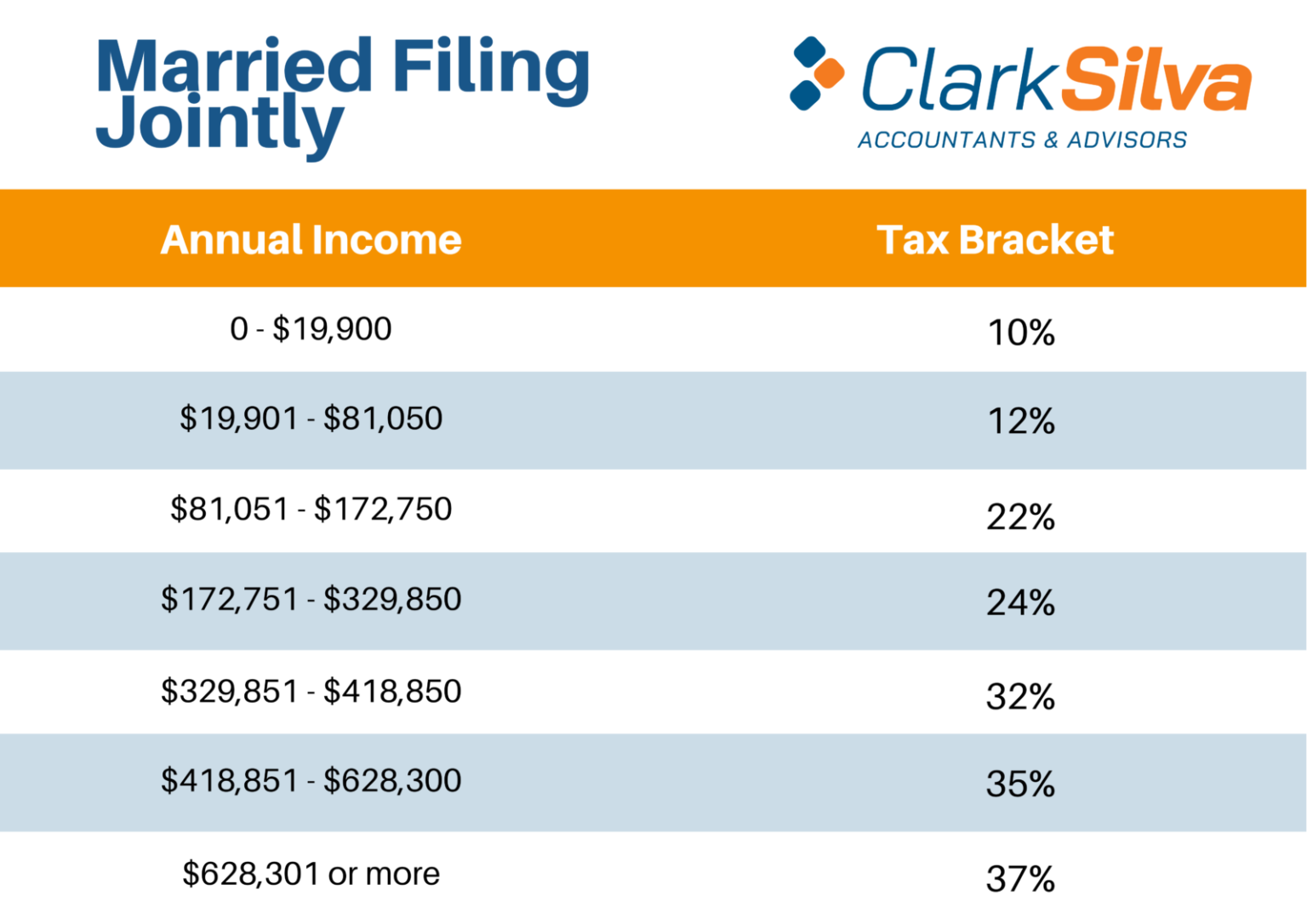

For 2022, as in 2021, 2020, 20, there is no limitation on itemized deductions, as that limitation was eliminated by the Tax Cuts and Jobs Act.The lowest rate is 10% for incomes of single individuals with incomes of $10,275 or less ($20,550 for married couples filing jointly). Marginal Rates: For tax year 2022, the top tax rate remains 37% for individual single taxpayers with incomes greater than $539,900 ($647,850 for married couples filing jointly).ģ5%, for incomes over $215,950 ($431,900 for married couples filing jointly) ģ2% for incomes over $170,050 ($340,100 for married couples filing jointly) Ģ4% for incomes over $89,075 ($178,150 for married couples filing jointly) Ģ2% for incomes over $41,775 ($83,550 for married couples filing jointly) ġ2% for incomes over $10,275 ($20,550 for married couples filing jointly).The personal exemption for tax year 2022 remains at 0, as it was for 2021, this elimination of the personal exemption was a provision in the Tax Cuts and Jobs Act.For single taxpayers and married individuals filing separately, the standard deduction rises to $12,9, up $400, and for heads of households, the standard deduction will be $19,400 for tax year 2022, up $600. The standard deduction for married couples filing jointly for tax year 2022 rises to $25,900 up $800 from the prior year.The tax items for tax year 2022 of greatest interest to most taxpayers include the following dollar amounts: The tax year 2022 adjustments described below generally apply to tax returns filed in 2023. Highlights of changes in Revenue Procedure 2021-45:

#Tax brackets 2021 married jointly standard deduction pdf

Revenue Procedure 2021-45 PDF provides details about these annual adjustments. WASHINGTON - The Internal Revenue Service today announced the tax year 2022 annual inflation adjustments for more than 60 tax provisions, including the tax rate schedules and other tax changes.

0 kommentar(er)

0 kommentar(er)